Comeback of Plastic Film Capacitors!

Growth in the plastic film capacitors market was sluggish in recent years, primarily due to economic austerity in Europe, where design engineers generally prefer them over ceramic capacitor technology. There is now evidence of a slowdown in global revenues for aluminum and tantalum capacitors and a corresponding increase in plastic film capacitor revenues. New research from Paumanok Publications, entitled “Paper & Plastic Film Capacitors: World Markets, Technologies & Opportunities: 2015-2020,” is predicting fair growth for plastic film capacitors, largely due to the global trend toward better energy efficiency in power electronics.

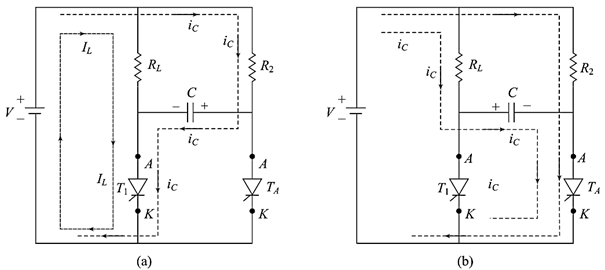

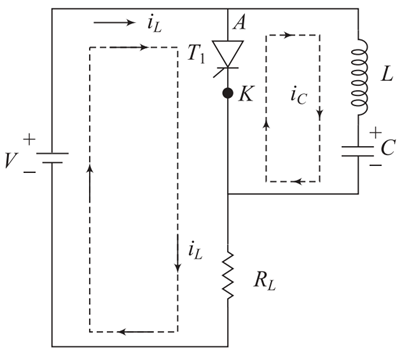

Plastic film capacitors find themselves in filtering, power factor correction, interference suppression, circuit protection, and pulsed power. They are thus critical components in everything from power transmission and distribution grids, to renewable energy systems, to lighting ballasts, to microwave ovens, to welding machines, to aircraft, to medical defibrillators.

Paumanok’s research report, which examines the global market for both AC and DC plastic film capacitors, found that the growth may be stimulated not only by customer demand for more energy-efficient electronics, but also by companies that are required to meet new energy regulations. According to Dennis Zogbi, CEO of Paumanok, the growth of plastic film capacitors, which are more expensive than their ceramic counterparts, probably wouldn’t be quite so robust if it were left to market conditions.

“This [drive toward plastic film capacitors] is counter intuitive to the market environment, but brought about by government regulations regarding power efficiency that were set in motion years ago without any visibility for economic conditions when milestones in regulations needed to be met,” Zogbi told Design News.

The research forecasts single-digit growth in terms of both value and volume for plastic film capacitors, and low single-digit rates of price decline for the capacitors over the next five years. The data also suggest that polypropylene dielectric capacitors will grow at a faster rate than polyethylene terephthalate dielectric capacitors and that plastic film capacitors employing exotic films such as polytetrafluoroethylene (PTFE), polyethylene naphthalate (PEN), and polyphenylene sulfide (PPS) will also grow at a faster rate than other dielectrics because of their ability to perform well in harsh environments and to self-heal (plastic film can repair minor tears in the dielectric caused by spikes, which makes them last longer than other types of capacitors).

There are some applications that are particularly relevant to plastic film capacitors, and those will be the primary drivers of growth.

“We see leading-edge opportunities for growth for polypropylene dielectric film capacitors for applications in variable speed drives and for DC link circuits in myriad established and emerging renewable energy systems,” Zogbi said. “Automotive opportunities in the electrification of the powertrain continue to abound, as do mission-critical markets in advanced weaponry and electric traction. PSC (permanent split capacitor) motor markets, which are a large market globally and which also consume polypropylene capacitors, are undergoing a significant change toward greater efficiency in HVAC systems and refrigeration, which is boosting markets in the West to meet government deadlines.”

Demand is being driven by both developed nations looking to increase energy efficiency and developing nations, where power transmission and distribution capacitor banks are being installed as building blocks to prepare for predictions of economic expansion.

latest video

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua